In today's ever-shifting economic landscape, achieving mastery over your finances isn't just a smart move—it's an absolute necessity. With financial stability becoming increasingly elusive and savings dwindling faster than ever, it's high time to bid farewell to the "leaky bucket" approach to money management. But fear not, because within this guide lies the power to transform your financial journey. We'll walk you through the steps of creating a monthly budget that not only plugs those financial leaks but also equips you with the knowledge to make savvy financial choices. And the best part? It's all made effortless with the help of an easy-to-use budgeting template. So, let's embark on this financial adventure together and secure your financial future.

Starting Your Budgeting Journey

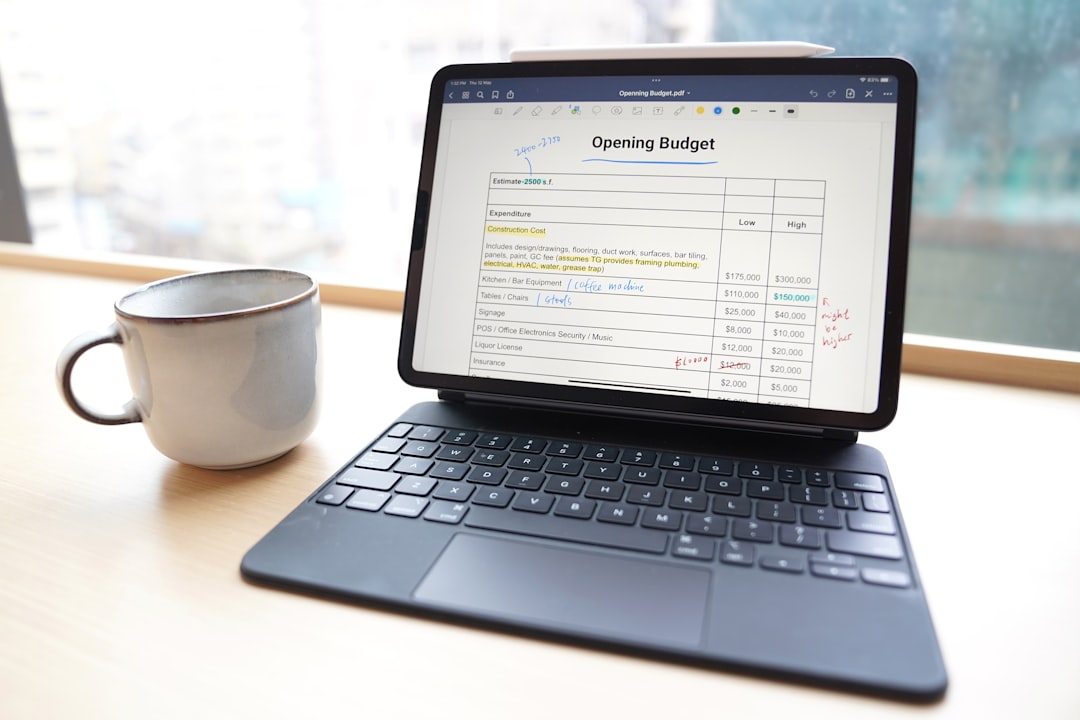

Photo by NORTHFOLK

Step 1: Get Started with the Easy Budgeting Template The first hurdle in easy budgeting is often the most challenging – getting started. Begin by accessing our easy budgeting template and compiling a comprehensive list of your monthly and quarterly expenses. This includes essentials like utility bills, rent or mortgage payments, car expenses, insurance, and any other regular costs. Don't forget those occasional expenses like license fees, car registration, or gift spending. Every expenditure must find its place in your budget to ensure accuracy.

Why it's Important:

Embarking on the journey of budgeting can be daunting, but it's a crucial step towards financial control and security. Getting started with our easy budgeting template is vital because it lays the foundation for your entire financial plan. By comprehensively listing your monthly and quarterly expenses, you gain a clear understanding of your financial landscape. This clarity empowers you to make informed decisions and take charge of your financial future. Every expense, whether routine or occasional, plays a role in this financial puzzle, and including them all in your budget ensures its accuracy. So, don't underestimate the importance of this initial step—it's the key to your financial success.

Handling Quarterly Expenses Effectively

Photo by Stephen Phillips

Step 2: Simplify Quarterly and Yearly Expenses To manage those less frequent expenses, break them down into manageable monthly portions using the easy budgeting template. A helpful approach is outlined in Budget Annual Spending by Erin Huffstetler on budgeting annual spending, which you can seamlessly integrate with our template.

Why it's Important:

Quarterly and yearly expenses often catch us by surprise, causing financial stress. This step is essential because it transforms those occasional financial shocks into manageable monthly commitments. By breaking down these expenses into bite-sized portions using the easy budgeting template, you gain financial predictability and control. The approach outlined in "Budget Annual Spending" by Erin Huffstetler ensures you won't be caught off guard by infrequent bills. This seamless integration with our template helps you create a budget that's not just monthly but also annually resilient, setting you on a path to financial stability. Don't let unexpected expenses derail your finances—simplify and conquer them with this vital step.

Documenting Your Income Strategically

Photo by Towfiqu Barbhuiya

Step 3: Document Your Income with the Easy Budgeting Template Next, gather your pay stubs and any other sources of income. Populate our easy budgeting template with both your income and expense figures. Feel free to customize field names to better suit your financial situation.

Why it's Important:

Understanding your income is as crucial as tracking your expenses. This step ensures that every financial aspect is accounted for. By documenting your income, including pay stubs and other sources, and populating our easy budgeting template, you create a comprehensive financial snapshot. This clarity empowers you to make informed decisions about your spending and saving. Moreover, the flexibility to customize field names in the template allows you to tailor your budget to your unique financial situation. This step bridges the gap between your earnings and expenditures, bringing you closer to financial equilibrium. So, take the time to document your income—it's the key to a financially secure future.

Documenting Your Income Strategically

Photo by Micheile Henderson

Step 4: Confront Reality with the Easy Budgeting Template It's not uncommon to discover that your spending surpasses your earnings. However, acknowledging this reality is the first step toward financial stability. By putting your financial situation on paper with the easy budgeting template, you gain clarity on where your money goes. This budgeting process, aided by a reliable spreadsheet, makes it easier to scrutinize your expenses and identify areas where you can cut back.

Why it's Important:

Facing the reality of your financial situation is the cornerstone of achieving financial stability. Many people find themselves spending more than they earn, and this step is essential because it helps you recognize this discrepancy. By using the easy budgeting template to document your finances, you create a tangible representation of your monetary flows. This process offers clarity and transparency, showing exactly where your money is going.

Moreover, the template serves as a powerful tool to scrutinize your expenses and pinpoint areas where you can cut back. It transforms vague financial worries into actionable insights, enabling you to make informed decisions about your spending habits. So, embrace this crucial step—it's the first stride toward a more secure and stable financial future.

Embrace the liberating power of our easy budgeting template as it transforms the often daunting task of budgeting into an accessible and manageable process. In a world filled with financial uncertainties, this tool becomes your steadfast companion, guiding you toward financial control and the tranquility that comes with it.

As you've navigated through the steps outlined in this guide, you've not only crafted a budget but also embarked on a journey of self-discovery. You've unearthed hidden spending habits, identified areas for improvement, and built a rock-solid financial foundation.

Now, armed with this newfound knowledge and our user-friendly template, you're poised to take charge of your financial destiny. It's more than just balancing the books; it's about shaping a brighter financial future. With each expense tracked and each saving goal realized, you're charting a course toward financial security and prosperity.

So, don't delay any longer. Begin your journey to financial freedom today. Use our easy budgeting template as your compass, and let it guide you toward a life of smarter spending, stronger savings, and a truly radiant financial future. Your path to financial success starts here.

Access our Easy Budgeting Template to get started on your financial journey today: Easy Budgeting Template